Aspiring leaders often face challenges securing funds due to a lack of experience and understanding common funding pitfalls. By recognizing and learning from errors like inadequate market research and poor investor presentations, future leaders can navigate financial landscapes with confidence. Effective funding management involves thorough research, robust business planning, transparency, and continuous learning from mistakes to prevent severe consequences for startups and organizations, ensuring sustainable growth and resilience. Case studies highlight the value of past failures in shaping successful leadership, offering practical knowledge for informed fundraising decisions.

“In the intricate dance of leadership, financial management is a critical yet often overlooked aspect. Many promising ventures have stumbled due to funding mistakes, offering valuable lessons for aspiring leaders. This article guides you through the labyrinth of common pitfalls, highlighting the impact of misused resources and providing practical strategies to avoid them.

From key factors to consider before investing to real-world case studies, we equip you with tools and insights derived from learning from funding mistakes, ensuring a more prosperous leadership journey.”

- Understanding Common Funding Mistakes in Leadership

- The Impact of Mismanaged Financial Resources

- Strategies for Preventing Funding Flaws

- Key Factors to Consider Before Investing

- Case Studies: Lessons from Real-World Examples

- Tools and Practices for Effective Funding Management

Understanding Common Funding Mistakes in Leadership

Many aspiring leaders fall into familiar traps when it comes to securing funds for their ventures, often due to a lack of understanding or experience. By recognizing and learning from these common funding mistakes, future leaders can navigate the financial landscape with greater confidence. One of the most prevalent errors is failing to conduct thorough market research, which leads to misconceptions about investment potential and unrealistic expectations. This mistake often results in poor funding decisions and can be avoided by thoroughly evaluating industry trends, competitor strategies, and target audience needs.

Another frequent blunder is inadequate preparation for investor interactions. Leaders who rush into pitching without proper structuring or fail to articulate their vision clearly may miss out on valuable opportunities. Effective communication and a well-defined business plan are essential when seeking funding. Understanding these typical pitfalls empowers leaders to implement preventive measures, ensuring they make informed choices and present compelling cases that resonate with investors.

The Impact of Mismanaged Financial Resources

Mismanaged financial resources can have a profound impact on any leadership journey. Funding mistakes, if left unaddressed, can lead to severe consequences for startups and organizations. These mistakes often result in inefficient resource allocation, causing a strain on cash flow and hindering growth opportunities. By learning from these funding blunders, leaders can navigate the financial landscape more effectively and ensure sustainable development.

When funds are not allocated wisely, it can create a ripple effect throughout the organization. Inadequate funding may delay project timelines, hinder hiring processes, and limit marketing efforts. Moreover, it can lead to a loss of faith from investors and stakeholders, making future funding rounds more challenging. Therefore, understanding and avoiding common financial mistakes is an essential aspect of successful leadership, fostering a path towards robust and resilient growth.

Strategies for Preventing Funding Flaws

Learning from funding mistakes is a critical aspect of effective leadership, as it helps to prevent future missteps and fosters strategic financial planning. To avoid common pitfalls, leaders should prioritize thorough research and analysis before committing resources. This involves assessing market demand, evaluating competition, and understanding the financial viability of the project or initiative. Developing robust business plans that include realistic revenue projections and cost assessments is paramount. Regularly reviewing and updating these plans based on performance data ensures agility and adaptability to changing circumstances.

Additionally, fostering a culture of transparency and open communication within the organization encourages early detection of potential funding issues. Encouraging feedback from all levels, especially those directly involved in project execution, provides valuable insights into challenges and areas for improvement. Regular financial audits and oversight committees can further mitigate risks by identifying anomalies or mismanagement. By embracing continuous learning from funding mistakes, leaders can cultivate a more resilient and financially astute organization.

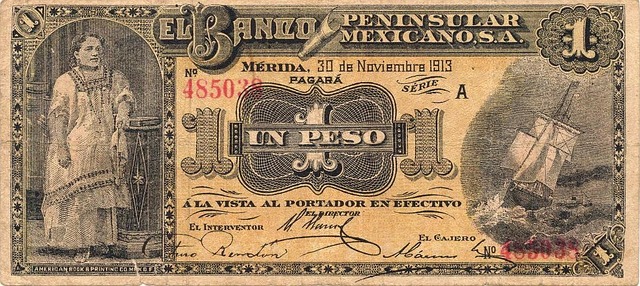

Key Factors to Consider Before Investing

Before investing funds, leaders should carefully consider several key factors to avoid common mistakes. Firstly, understanding the project’s viability and its potential return on investment is paramount. This involves thorough market research and a clear, well-defined business plan. Leaders must assess not only the financial projections but also the social and environmental impact of their investment, ensuring alignment with long-term strategic goals.

Secondly, learning from funding mistakes often highlights the importance of due diligence. Evaluating the team behind the project is crucial; their experience, expertise, and track record can significantly influence success or failure. Additionally, understanding the risks associated with the investment, including potential market shifts or regulatory changes, enables leaders to make more informed decisions and develop mitigation strategies.

Case Studies: Lessons from Real-World Examples

Learning from Funding Mistakes: Case Studies in Real-World Leadership

Many successful leaders attribute their achievements to lessons learned from past failures, and funding mistakes are no exception. Examining real-world case studies provides invaluable insights into how leaders can navigate financial challenges and avoid potential pitfalls. For instance, the story of Company X offers a stark reminder of the importance of thorough due diligence when seeking investment. By failing to accurately assess market trends and competitive landscapes, they mismanaged investor expectations and struggled to secure follow-on funding. This experience highlighted the need for comprehensive research and realistic financial projections before approaching investors.

Conversely, Company Y’s successful fundraising campaign can teach leaders about the power of a compelling narrative. They effectively communicated their unique value proposition and secured funding from both traditional and alternative sources. This case study underscores the significance of storytelling in pitching to investors and the importance of tailoring messages to different audiences. Understanding these real-world examples equips leaders with practical knowledge, ensuring they make informed decisions when seeking funding and steer clear of common mistakes along the way.

Tools and Practices for Effective Funding Management

Effective funding management is a critical skill for leaders, and one that can be greatly enhanced by learning from previous funding mistakes. Firstly, establishing clear financial goals and budgets is essential. Leaders should define specific milestones and outcomes for each project or initiative, ensuring these are realistic and aligned with the organization’s vision. Regularly reviewing and adjusting budgets based on performance data allows for more accurate allocation of resources and minimizes wastage.

Additionally, implementing robust tracking systems and transparent reporting practices aids in monitoring funding utilization. Using specialized software or spreadsheets to record expenses, track milestones, and generate regular financial reports can help identify potential overspends or inefficiencies early on. Regular team meetings focused on budget health and learning from both successes and failures further reinforce responsible funding management.